how to declare mileage on taxes

The standard mileage rate is easy to calculate. Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle.

2020 Form Irs 2290 Fill Online Printable Fillable Blank In Irs W9 Form 2021 Calendar Template Irs Forms Printable Calendar Template

You can also add your.

. Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. For 2020 the rate was 575 cents per mile. This rate covers all the costs of.

Gas repairs oil insurance registration and of course. Youll need two figures. How to claim mileage on taxes.

Dont Know How To Start Filing Your Taxes. Your mileage deduction isnt hard to calculate if youve kept accurate records in your logbook. Take away any amount your employer pays you towards your costs sometimes called a mileage allowance Approved.

INSTRUCTIONS FOR TABLE A. You can deduct a fixed rate of 56 cents per mile in 2020. The Standard IRS Mileage Deduction.

So if you owe 100000 in tax for the current year there would be no penalty if you paid 100 of the tax shown on your return for the prior year even if the tax. In this instance a log. How to Log Mileage for Taxes in 8 Easy Steps 1.

Total kilometres you drove during the year Total. Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. Dont Know How To Start Filing Your Taxes.

Connect With An Expert For Unlimited Advice. The IRS Standard Mileage rate is the standard mileage reimbursement rate set by the IRS each year so that employees contractors and employers. Deduct your employers mileage limit if applicable.

Theres a difference. As noted above there are certain conditions that qualify taxpayers to. And Canada Dashers- To keep track of your total mileage and maximize your business-related deductions on your 2022 tax return we recommend using mileage tracking.

Claiming mileage on taxes can add up to a hefty deduction for many people but the IRS has specific rules regarding when and how it can be claimed. IRS STANDARD MILEAGE RATE. Gambling winnings are fully taxable.

Can You Claim Gasoline And Mileage On Taxes. Make Sure You Qualify for Mileage Deduction. This is the easiest method and can result in a higher deduction.

Currently this rate is 575 for 2015. 419 Gambling Income and Losses. Increase your annual mileage according to the applicable AMAP rate.

To use this method multiply your total business miles by the IRS Standard Mileage Rate for. Heres how to write off mileage on taxes. The rules regarding how you can declare your vehicle as a business vehicle for tax purposes apply regardless of whether you lease or own your vehicle.

If you use the. If your employer pays a mileage allowance below the rate allowed by HMRC you can claim the difference as a tax relief. MILEAGE TAX RATES.

Use these rates only when operating at declared weights of 80000 pounds or less. Find out how much you can claim. The following rules apply to casual gamblers who arent in the trade or business of gambling.

If youre using the standard mileage rate first calculate the value of your deduction. You need to keep track of your total number of miles that you drove during the year and the total number of miles you drove for. HMRC rates are 45p per mile for the first 10000 miles.

Use Table B rates for. If you use a leased vehicle. Standard IRS Mileage Deduction.

Use the actual expense method to claim the cost of gasoline taxes oil and other car-related expenses on your taxes. In this instance a log would be kept of the mileage used for business and multiplied by the deduction rate published by the IRS. Connect With An Expert For Unlimited Advice.

Add up the mileage for each vehicle type youve used for work.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

How Do I Tailor My Self Assessment Tax Return Youtube

Tracking Your Taxes For Direct Sales Consultants Direct Sales Direct Sales Consultant Scentsy Business

How To Report Inventory At Income Tax Time When You Are A Home Party Sales Rep Homepartysales Direct Pure Romance Consultant Pure Romance Pure Romance Party

Free Income And Expenditure Form Online Income Personal Finance Blogs Finance Blog

Tax Returns Advice And Information For Musicians Insure4music Blog

Self Employed Guide How To Claim For Business Mileage

Mileage Allowances What Is Tax Free

Everything You Need To Know About Mileage Allowance Finmo

How To Fill Out Your Self Assessment Tax Return This Is Money

Simplify Your Tax Records With These Tips Simplify Business Tips Tax

How Do I Claim My Mileage Back From Hmrc

Instantly Download Free Sample Vehicle Delivery Note Template Sample Example In Pdf Microsoft Word Doc Microsoft Excel X Notes Template Templates Words

Guide To Business Expenses Accountants Etc

The Top 10 Self Assessment Tax Return Mistakes 1st Formations

Ltd Companies Director S Expenses You Should Claim 2022

How To Declare Taxes As An Independent Consultant Sapling Jamberry Business Thirty One Business Independent Consultant

Blog Tax Deductible Landlord Expenses The Ultimate Checklist

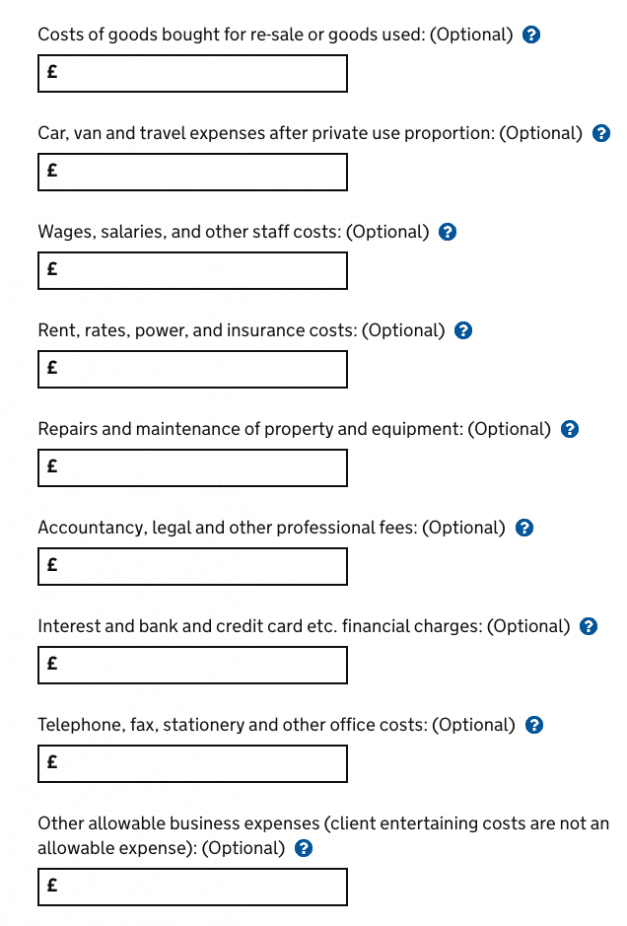

How To Complete The Self Employment Section Of Your Tax Return